Tea industry struggles amid rains, lockdown, and buyers turning to Kenya

Heavy rains and the absence of tea pickers because of lockdowns have hammered production and sent local prices spiraling to records India’s long-established tea industry is struggling.

Heavy rains and the absence of tea pickers because of lockdowns have hammered production and sent local prices spiraling to records, while top buyers are turning to Kenya where the market has dropped, said Azam Monem, director at Mcleod Russel India, one of the country’s biggest growers.

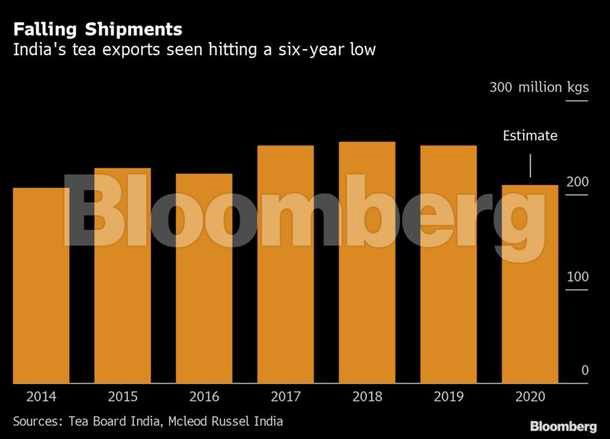

Output in the world’s second-largest producer is set to shrink to the smallest in five years, falling 13 per cent to about 1.21 billion kilograms, while exports will drop 16 per cent to about 210 million kilograms, a six-year low, according to Monem.

The tea industry is going through a tough time, Monem said in an interview. Domestic production is falling after excessive rain in June and July and because lockdowns kept workers away from the plantations, while importers in the UK, Egypt, and the West Asia may switch to Kenya, he said.

Auction prices in the African nation have fallen after production of black tea climbed more than 40 per cent in the first half from a year earlier on good weather, according to the Tea Directorate. By contrast, prices are at a record in the main growing areas of India, Monem said. Average prices jumped about 60 per cent between April and early August from a year earlier, he said. Still, even with the higher prices, lower volumes are hurting the cash flow of Indian tea companies, Kaushik Das, analyst at ICRA, said in a report.

Source: Business Standard

Tea industry in India suffers double whammy from rains and Kenya

INTERNATIONAL - India’s long-established tea industry is struggling.

Heavy rains and the absence of tea pickers because of lockdowns have hammered production and sent local prices spiraling to records, while top buyers are turning to Kenya where the market has dropped, said Azam Monem, director at Mcleod Russel India Ltd., one of the country’s biggest growers.

Output in the world’s second-largest producer is set to shrink to the smallest in five years, falling 13% to about 1.21 billion kilograms, while exports will drop 16% to about 210 million kilograms, a six-year low, according to Monem.

The tea industry is going through a tough time, Monem said in an interview. Domestic production is falling after excessive rain in June and July and because lockdowns kept workers away from the plantations, while importers in the U.K., Egypt and the Middle East may switch to Kenya, he said.

Auction prices in the African nation have fallen after production of black tea climbed more than 40% in the first half from a year earlier on good weather, according to the Tea Directorate. By contrast, prices are at a record in the main growing areas of India, Monem said. Average prices jumped about 60% between April and early August from a year earlier, he said.

Still, even with the higher prices, lower volumes are hurting the cash flow of Indian tea companies, Kaushik Das, analyst at ICRA Ltd., said in a report.

Source: Bloomberg

Production shortfall not alarming to warrant duty-free import of tea, say industry insiders

Tea exports took a hit during the first five months (up to May 2020) falling by 26.61 per cent to 74.40 mn kg (101.38 m kg)

However, production shortfall is helping the small tea growers of South India get good prices for the leaf

All-India tea production during the first half of 2020 (January to June) has slipped by 26.37 per cent to 348.26 million kg, compared 472.96 mn kg in the corresponding period of the previous year.

While the fall appears steep, industry sources contend that the situation is “not alarming” to warrant import of tea at this juncture. “We still have another six months and this drop can be easily recouped,” the source said.

Tea Board statistics show that tea production in North India had fallen by almost 33 per cent between January and June 2020 to 249.83 mn kg (372.48 mn kg), compared to the 2 per cent drop in South India’s production to 98.43 mn kg (100.48 mn kg).

Industry insiders attribute it to the closure of gardens due to the Covid-19-led lockdown, and estimate the average shortfall at not more than 9 per cent.

While a balance sheet on tea was not readily available, considering that India has been a surplus tea producing nation, and that production has only climbed year-after-year in the last five years, the drastic drop in production during the first half of the current calendar year, sources say “has not been due to factors beyond our control”.

In hindsight, the production shortfall has been a blessing for the small tea grower community in South India, as they are able to get a reasonably good price for the green leaf.

Meanwhile, tea exports took a hit during the first five months (up to May 2020) falling by 26.61 per cent to 74.40 mn kg (101.38 m kg).

Industry sources state that the production shortfall has been set off by the drop in export volumes, and therefore, adequate quantities would be available for domestic consumption

While only provisional consumption data is available, the trend indicates a gradual increase with every passing year. “Our per capita consumption of tea is still way below some of the tea exporting countries,” the source said.

Does the situation warrant duty-free import of tea to tide over the shortfall? “Certainly not” say industry stakeholders, although a section of tea packeteers and traders seem to be voicing the need for a “one-time import”.

The apex body of planters in the South — United Planters’ Association of Southern India (UPASI) — has objected to the move to tinker with the import duty structure for tea, stating that it would be counter-productive.

An industry stakeholder told BusinessLine that importing teas for re-export would be justifiable, but considering to bring cheaper teas into the country is “objectionable”, as it would be at the cost of the grower community.

There is a free-flow of appeal and counter-appeal — for and against import of tea — as industry watchers stress the need for protecting the domestic tea industry.

Source: The Hindu BusinessLine